Thursday, December 8, 2011

Zen Trades for 12/7 on TF

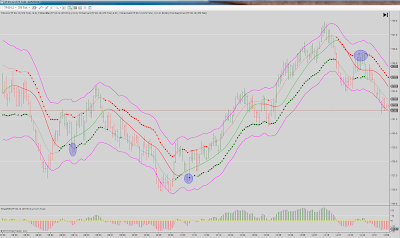

Only two trades today on the TF. But both were massive winners. The first was a long which all 3 of our profit targets of 36, 72, and 150 ticks were reached. The second was a smaller counter-trend winner. Great day!

Zen Trades for 12/6 on TF

All trades are managed with 12 tick stops on the TF, and scaling targets of 36, 72, and 150 ticks. The entire trade is removed upon a break of the trend.

Tuesday, December 6, 2011

Trading Philosophy

The concept behind the "Zen Trading" philosophy is a tight stop and large profit targets. With this type of money management, large returns are possible with very minimal draw down. With each individual trade, I am risking no more than 2.5% of account value. My stop is always 12 ticks and my first target is typically 36 ticks. This is a 1/3 risk/reward ratio on the first target. Depending on the trade, 72 ticks is usually the second target and the third is held until a break of trend.

More to come...

More to come...

Zen Trades for 12/5 on TF

There were three trades on the TF for 12/5. A long at 743.5, a short at 749.5, and a short at 751.5. The third trade being the most profitable.

Zen Trades for 12/5 on ES

There were three Zen Trades for the ES on 12/5. A long at 1259.75, short at 1264, and and a short at 1264.25 around noon. The third trade by far being the most profitable.

Saturday, December 3, 2011

Friday, December 2, 2011

Learning to Zen Trade

Learning how to become a "Zen Trader", or someone who profits week after week while trading, is not easy. These are five points that I have found to be the most important in my trading. I have learned many of these the hard way, so I hope this can help a new trader avoid a few pitfalls.

1). Money management is important.

Realize how much risk you are taking with each trade. The stop on your trade should not exceed a 2.5% loss of account value. For example, a $200/trade risk should have an account value of $8000. This will help you realize your risk and not "break the bank" with a few losers. You obviously would prefer the trade to work, but you will trade again if you take a few stops. Expect at some point in your trading you may take 5 or 6 stops in a row. This will hopefully not happen often, but it will happen at some point so you need to be emotionally prepared.

2). Discipline is a not an option.

Do not move your stop. Ever. Do not double down on losers. Do not try to focus on getting back to break even. Set your stop, set your targets, and develop a strategy for moving your trade to break even quickly. Do not think a trade is unique and should be handled differently given the situation. Big deal. Every trade is different and the only constant is your trade discipline. You need to trade the same way every time.

3). Instant Execution is a must.

You need to pull the trigger when your system says "go" every time. If you hesitate, you may miss your entry. As a result, you may attempt to chase your entry which always leads to bad habits and desperate trading. Hopefully you have found some kind of an edge on the market, so do not get in the way of your market edge by not taking the trades when the entries present themselves.

4). Maintain a level head. Relax.

Trading is fun. If you are not having fun while you trade then you are not going to be successful. Anger, desperation, frustration, fear, anxiety are all emotions that will hurt your trades. Taking three of four stops in a row can be very emotionally challenging. If you start to feel like you need to make your money back, then stop trading. You can not have this mindset as a trader. Each trade is independent of the next and Mother Market will not treat you differently because you lost a few trades. Becoming emotional results in taking more unnecessary risk. This is a problem and can lead to larger losses. If you can not keep the same pattern of trading due to a few losses, then quit for the day.

5). Reflect

Keep a journal of your trades so you can grow as a trader. Constantly ask yourself how you can improve the trade to squeeze out more profit. Make these decisions OUTSIDE of market hours. During market hours you are only executing your plan. There is no time for thinking while you trade. Thinking is for after the market closes and over the weekend. Once you are in the trade, you are executing the plan. Reflect on the result of the plan after hours and over the weekend, not during trading hours.

Enjoy your weekend!

http://www.youtube.com/watch?v=Cqg_ZGcuybs&feature=related

1). Money management is important.

Realize how much risk you are taking with each trade. The stop on your trade should not exceed a 2.5% loss of account value. For example, a $200/trade risk should have an account value of $8000. This will help you realize your risk and not "break the bank" with a few losers. You obviously would prefer the trade to work, but you will trade again if you take a few stops. Expect at some point in your trading you may take 5 or 6 stops in a row. This will hopefully not happen often, but it will happen at some point so you need to be emotionally prepared.

2). Discipline is a not an option.

Do not move your stop. Ever. Do not double down on losers. Do not try to focus on getting back to break even. Set your stop, set your targets, and develop a strategy for moving your trade to break even quickly. Do not think a trade is unique and should be handled differently given the situation. Big deal. Every trade is different and the only constant is your trade discipline. You need to trade the same way every time.

3). Instant Execution is a must.

You need to pull the trigger when your system says "go" every time. If you hesitate, you may miss your entry. As a result, you may attempt to chase your entry which always leads to bad habits and desperate trading. Hopefully you have found some kind of an edge on the market, so do not get in the way of your market edge by not taking the trades when the entries present themselves.

4). Maintain a level head. Relax.

Trading is fun. If you are not having fun while you trade then you are not going to be successful. Anger, desperation, frustration, fear, anxiety are all emotions that will hurt your trades. Taking three of four stops in a row can be very emotionally challenging. If you start to feel like you need to make your money back, then stop trading. You can not have this mindset as a trader. Each trade is independent of the next and Mother Market will not treat you differently because you lost a few trades. Becoming emotional results in taking more unnecessary risk. This is a problem and can lead to larger losses. If you can not keep the same pattern of trading due to a few losses, then quit for the day.

5). Reflect

Keep a journal of your trades so you can grow as a trader. Constantly ask yourself how you can improve the trade to squeeze out more profit. Make these decisions OUTSIDE of market hours. During market hours you are only executing your plan. There is no time for thinking while you trade. Thinking is for after the market closes and over the weekend. Once you are in the trade, you are executing the plan. Reflect on the result of the plan after hours and over the weekend, not during trading hours.

Enjoy your weekend!

http://www.youtube.com/watch?v=Cqg_ZGcuybs&feature=related

Subscribe to:

Posts (Atom)