I loaded up on calls in NUGT and AGQ yesterday.

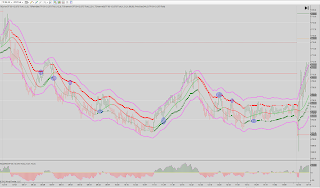

A dip from here before next week is still in the cards and a retrace back to longer period MAs should be bought. However, we may just run higher into mid-November.

If you missed the run before, scale in now but prepare for potential drawdown in the shorter term. GDX and GDXJ should see fresh highs before month end.

Current Positions

Swing

100 Mar16 42/52 Vertical call spread @ $297 Debit (if you are not familiar with call spreads, do not attempt to make this trade)

100 - AG Jan17 2.50 call @ $179 basis

200 - AGQ Mar16 41 call @ $285 basis

300 - TZA shares @ 46.17 basis

20 - SPY Jan 16 193 Put @ 4.24 basis

Long term

Accumulating shares in GDX, GDXJ, SIL, UCO, XLE for 1 - 3 year hold

Zen Trader

Thursday, October 22, 2015

Friday, September 18, 2015

GOLD MINERS = $$$$

I finally closed out my JNUG, NUGT, and USLV bullish positions here with massive profits.

I expect this to be a long term trend change for the miners and we are headed much, much in the intermediate and longer term.

I will look to re-enter some equity positions in JNUG and NUGT on the next move lower.

My long term positions in GDX, GDXJ, SLW, NEM, and AG are all intact.

I expect this to be a long term trend change for the miners and we are headed much, much in the intermediate and longer term.

I will look to re-enter some equity positions in JNUG and NUGT on the next move lower.

My long term positions in GDX, GDXJ, SLW, NEM, and AG are all intact.

Wednesday, August 12, 2015

LOCKING IN PROFITS

I locked all of my gains today in $NUGT and $JNUG securing massive gains. I have made over 20% on my account over the past week with minimal risk.

I sold half my Jan17 $10 calls on $JNUG for double the premium. Risk removed.

I am holding 100% of my Jan17 $5 calls on $NUGT and turning them into call spreads by selling Jan17 $8 calls @ 1.75 with order pending.

Great Great Great week ;-)

I sold half my Jan17 $10 calls on $JNUG for double the premium. Risk removed.

I am holding 100% of my Jan17 $5 calls on $NUGT and turning them into call spreads by selling Jan17 $8 calls @ 1.75 with order pending.

Great Great Great week ;-)

Monday, August 10, 2015

Hiatus

After taking a major hiatus from blogging, I have decided to start blogging again.

Over the past three years, a great deal has changed in regards to my trading strategy. I will use this as a trade journal to document my thoughts and my ideas and keep a record of my positions.

Today I took profits out of my gold and silver mining equity shares for nice gains from last week in JNUG, NUGT, and USLV but I am still holding my options on JNUG and NUGT.

OPEN POSITIONS:

35 JAN17 $10 Call JNUG Cost basis: $4.85

150 JAN17 $5 Call NUGT Cost Basis: $1.39

I believe we are about to witness a short term squeeze in gold and silver mining shares over the next few months that will make these positions highly profitable. The trade plan is to pull half of the calls when I am up 100%. If we see a down move in miners this month, I expect it to be followed by massive short covering and may add to my position.

Trade Safe,

Braden

Over the past three years, a great deal has changed in regards to my trading strategy. I will use this as a trade journal to document my thoughts and my ideas and keep a record of my positions.

Today I took profits out of my gold and silver mining equity shares for nice gains from last week in JNUG, NUGT, and USLV but I am still holding my options on JNUG and NUGT.

OPEN POSITIONS:

35 JAN17 $10 Call JNUG Cost basis: $4.85

150 JAN17 $5 Call NUGT Cost Basis: $1.39

I believe we are about to witness a short term squeeze in gold and silver mining shares over the next few months that will make these positions highly profitable. The trade plan is to pull half of the calls when I am up 100%. If we see a down move in miners this month, I expect it to be followed by massive short covering and may add to my position.

Trade Safe,

Braden

Thursday, June 28, 2012

Back to basics

Today I was inspired to start using this blog as a trading journal due to my ability to repeat past mistakes despite my exhaustive efforts not to repeat errors. I feel the best way for me to get over the hump of continually kicking myself after bad trades may be to write it down.

Today was an extremely volatile day in CL. The day opened with a long trade, where I entered premarket and (too quickly) exited 2/3 contracts for a small profit. The third was left on just as my power went out. When the power finally came back on an hour later, I had been stopped out for break even. The rest of my day seemed to go downhill from here. A forced long attempt with a loose stop gave me a large loser, followed by quick shorts pulled for small profits, and then finally a long attempt which I averaged down into to make back some of my losses on the day. I finished the day with a small gain, but it was a rollercoaster.

Lessons from today:

Stay with the system. Despite my repeated gut attempts to pick a bottom. It is a losing battle.

Follow your instincts. Every indicator hinted at a continuation lower, however I was covering contracts too quickly to make small gains rather than focus on larger trend of the day.

Do not go on tilt. In other words, the market will do it's thing with or without you. Accept it and keep a level head.

These are my thoughts for the day and continue to be the mantra of trading every day.

Tomorrow, my goal will not be to make money, but trade effectively. To do this, no trade will be held more than 4-5 ticks beyond the dots and all profits will be scaled starting with a candle violation or pink line.

I will inform you of my progress tomorrow. I will post some charts as well of my trades.

Today was an extremely volatile day in CL. The day opened with a long trade, where I entered premarket and (too quickly) exited 2/3 contracts for a small profit. The third was left on just as my power went out. When the power finally came back on an hour later, I had been stopped out for break even. The rest of my day seemed to go downhill from here. A forced long attempt with a loose stop gave me a large loser, followed by quick shorts pulled for small profits, and then finally a long attempt which I averaged down into to make back some of my losses on the day. I finished the day with a small gain, but it was a rollercoaster.

Lessons from today:

Stay with the system. Despite my repeated gut attempts to pick a bottom. It is a losing battle.

Follow your instincts. Every indicator hinted at a continuation lower, however I was covering contracts too quickly to make small gains rather than focus on larger trend of the day.

Do not go on tilt. In other words, the market will do it's thing with or without you. Accept it and keep a level head.

These are my thoughts for the day and continue to be the mantra of trading every day.

Tomorrow, my goal will not be to make money, but trade effectively. To do this, no trade will be held more than 4-5 ticks beyond the dots and all profits will be scaled starting with a candle violation or pink line.

I will inform you of my progress tomorrow. I will post some charts as well of my trades.

Sunday, January 1, 2012

December TF Trades

12/8 TF Trades

Only one long entry today after missing the morning action. Stop for a loss.

12/9 TF Trades

Again a difficult day. Market trended higher all day and left me attempting to wait for momentum to slow. One short entry for break I took a couple scalps long for small profit.

12/12 TF Trades

Short entry near the open for a small winner. Long for small winner. Short for a stop. Long for small winner and then a really nice short trade followed by a really nice long trade near end of day. Sometimes a lack of market movement after a big move can cause feelings of "I missed the move" and a belief that jumping in is the right thing to do. It never is the right thing to do. Always wait for your entry.

12/13 TF Trades

Technically the morning short should not be taken since the channel was not broken, but I took it. I saw heavy resistance above after a strong overnight move and believed it was worth the risk. While I do believe in always following your rules, I also believe you can still take trades that don't meet all of your criteria AS LONG AS your stop never changes. 11AM short for a small winner followed by a very nice end of day short.

12/14 TF Trades

Attempted short for a stop, then attempted long for a stop, then a nice short which worked well and a long for a small profit. Another nice long presented itself and two more nice shorts to make the day very profitable.

12/15 TF Trades

Short entry for a nice win. Two longs for nice wins. A short for a stop. Another short for a break even.

12/16 TF Trades

Nice long in the morning, but missed it. Hung out down by the dots for too long and pulled this one. Good example of not over analyzing tick movement. Very nice short set up around 10AM which was extremely profitable. Put the full short back on at the dots again for another nice gain. Took a long around 12:35 for small win. Ended the day with a couple break evens.

12/19 TF Trades

Frustrating morning. Break even, stop, missed down move, then another break even. And then finally a nice winner in the afternoon. Patience is a virtue.

12/20 TF Trades

Okay this was a hard day. When strong trend days occur they often defy logic. Market continues in one direction without ever looking back and it becomes better to follow trend and sit back. Unfortunately I did not do this. I took a short for a stop, another short for a stop, a long for a break even and then a long for a winner to finish the day slightly in the green. Finishing a day like today in the green is an accomplishment for me.

12/21 TF Trades

Nothing notable. A couple winners, a couple break evens and 1 stop. Nice afternoon up trend made my day.

12/22 TF Trades

Short for a winner, break even, and a short for a small winner. Volume very light....

12/23 TF Trades

Volume non-existent. Tried a long a quick buck and reversed trade short but took a stop. Finished day slightly in green but nothing exciting.

12/28 TF Trades

Nice morning shorty. Long around noon for a small gain.

12/29 TF Trades

No comment. Brain on vacation on this day. Two trades nothing exciting.

12/30 TF Trades

Nice short to end the year! HAPPY NEW YEAR!

December ES Trades

12/7 ES Trades

Not many trades taken in the morning as the market never presented a short entry. I suppose a short could have been taken pre-market and held through the open, but I typically do not look to hold positions into the open when trading overnight. The first entry was around 10AM CST for a long @ 1242 which held the channel all the way to 1252. Scales were made at 1245 and 1249 and the entire trade removed at 1250 with a break of the higher high pattern. A short entry occurred at 1:30PM @ 1250.50 and was removed in full at 1246.

12/8 ES Trades

Not an exciting day for trading the ES. One long entry taken for a 1.5 point loss.

12/9 ES Trades

Difficult day. Short taken early for a stop. Another short attempt for another stop. One final long made up for first two losses and put the ES trades slightly in the green for the day.

12/12 ES Trades

When a trend forms and runs and does not produce an entry it can lead to frustration and mistakes in trading. In this particular situation, I wanted to get short in the morning but the market never provided an entry. Oh well. Next time. One long taken for small gains in the afternoon was only ES trade for the day.

12/13 ES Trades

Nice day today. We were given a nice long in the morning. Another small long winner and then a great short entry in the afternoon. The last order was taken at the channel instead of the dots with a wider stop. I believe this is justified when the trend is strong enough. Rather than a 6 tick stop, I have it a 10 tick and was looking for more profits. The trade worked very well as the market continued to sell. Scales occured at +4, +8, and +20.

12/14 ES Trades

Nice short in the AM. Quick stop on a long attempt. Another nice short in the afternoon. +10 on the day.

12/15 ES Trades

Just another day of picking away at small winners. Quick long and then two short setups in the afternoon all for decent profit.

12/16 ES Trades

Quick short in the morning for a small winner. A second trade in the afternoon for a small winner. 2 or 3 points on each trade.

12/19 ES Trades

A couple beauties today. First trade of the day was a textbook short. Shorted 1216.50 with scales at +4, +6.5, and +12. This was followed by a long for a 3 point winner. Another short end of day for a nice winner. Really nice setups.

12/20 ES Trades

Some days you watch the market move and you are not in it. I used to chase days like this but through experience and losing $$. If the entry doesn't present itself, I just watch. No trades other than scalping a couple longs for a couple points. This was not a trend to fight.

12/21 ES Trades

Nice short in the morning. Quick long for a few points. Ended the day with a beauty long.

12/22 ES Trades

Not too exciting. Long for a few points followed by a break even short.

12/23 ES Trades

Christmas trading. Tried a short and took it off quick for a point. That was all.

12/28 ES Trades

More boring trading. No short entry in the AM. Tried a long for a few tick loss.

12/29 ES Trades

One nice long on the day. That was the only trade.

12/30 ES Trades

Took a couple shorts for few points each. Second short was more profitable in the close.

Subscribe to:

Posts (Atom)